We’re Not Just in the Business of Wealth. We’re in the Business of Clarity.

The more wealth you accumulate, the more complex your life becomes — and complexity demands clarity. We created a Virtual Family Office to give high-net-worth individuals a better way to manage their finances: coordinated, customized, and led by a team that knows how to handle the whole picture.

What is a Virtual Family Office?

A Virtual Family Office (VFO) brings the benefits of a private family office — historically reserved for ultra-wealthy families — to successful individuals and business owners who want the same level of integration, without the need to build their own team.

Rather than working with disconnected professionals, you gain access to a unified network of experts who collaborate through one central relationship — us. We act as your point person, your planner, and your long-term advocate.

At our firm, your Virtual Family Office coordinates every piece of your financial lifE::

✔ Investment strategy

✔ Tax mitigation

✔ Estate planning

✔ Risk protection

✔ Charitable giving

✔ Legal & insurance advisory

Common Frequently Asked questions

Smart Questions. Straight Answers.

What exactly is a Virtual Family Office — and how is it different from a typical advisor?

A Virtual Family Office (VFO) provides centralized coordination of all aspects of your financial life — from investments and taxes to estate planning and risk protection. Unlike traditional advisors, we integrate a full network of CPAs, attorneys, and insurance professionals into one collaborative strategy, led by a single point of contact: us. You get more clarity, fewer silos, and smarter outcomes.

Do I need to live in Clear Lake or Urbandale to work with you?

Not at all. While we have offices in both locations and meet many clients in person, we also work virtually with clients across Iowa and the Midwest. Whether you’re in Des Moines, Mason City, or out of state, our model is built to support seamless remote collaboration.

What types of clients do you typically work with?

We specialize in working with high-net-worth individuals — most commonly business owners, corporate executives, and medical professionals — with $1M to $10M+ in investable assets. We also work with multi-generational families focused on legacy planning, charitable giving, or preparing for major liquidity events.

Will I still keep my CPA, attorney, or insurance agent?

Yes — and we’ll help you get even more value from those relationships. Our role is to coordinate communication, clarify strategy, and ensure nothing slips through the cracks. If you don’t already have key professionals in place, we can introduce you to vetted experts through our trusted network.

What’s your process for new clients?

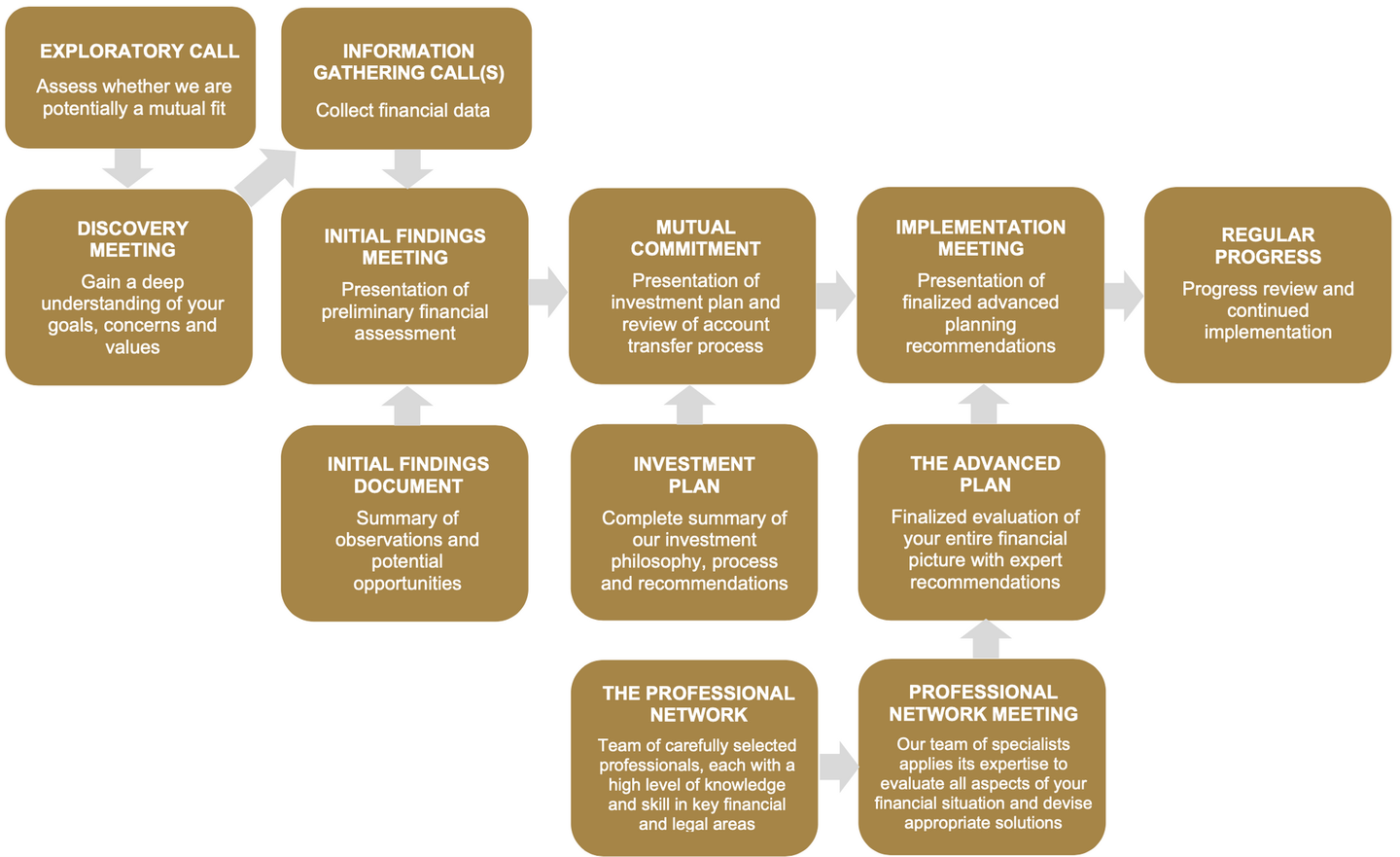

Everything starts with a Discovery Meeting. We listen, ask questions, and assess whether our process is the right fit for your goals. From there, we walk you through a structured engagement that includes a financial stress test, personalized recommendations, and full implementation support.

Meet Scott Etzel

As a Chartered Retirement Planning Counselor, (CRPC®) I am specifically qualified & committed to maintaining a high standard of integrity and professionalism in my relationship with you, my client. I earned a bachelor’s degree in business administration from Grand View University in 1995 and achieved the CRPC® certification in 2007 by meeting rigorous professional standards & successfully completing the College for Financial Planning’s examination. Additionally, I hold securities registrations (Series 66 (Uniform Investment Adviser - Combined State Law) & Series 7 (General Securities Representative), earned in 2007), along with state insurance licenses, which empower me to provide a broad spectrum of advisory services and tailored financial solutions.

My approach to Wealth Management is both comprehensive & client-centered, addressing the diverse financial needs of high-net-worth individuals, including doctors, professionals, and closely held business owners.

A Seasoned Guide for Complex Financial Journeys

The Wealth Management Consultative Process

Our consultative process is structured, intentional, and entirely focused on you.

From the first conversation to implementation, we follow a clear framework that uncovers your goals, evaluates your current strategies, and delivers custom recommendations backed by deep expertise.